States Can Adopt or Expand Earned Income Tax Credits to Build a Stronger Future Economy

By Erica

Williams and Michael

Leachman

January 30, 2014 - Center on Budget and Policy Priorities

Half of all states plus the District of Columbia have enacted their own

version of the federal Earned Income Tax Credit (EITC) to help working families

earning low wages meet basic needs. State EITCs build on the success of

the federal credit by keeping working parents on the job and families and

children out of poverty. This important state support also extends the

federal EITCfs well-documented long-term positive effects on children, which in

turn boosts the nationfs future economic prospects.

State EITCs provide extensive benefits to children, families, and

communities, and are straightforward to administer and to claim. Lawmakers

in states without their own EITC should consider enacting one. States

that have cut back or eliminated their state credits should reverse course and

bring the credits back. With this important investment, states can make a

big difference in the lives of low- and moderate-income working families.

Why Consider an EITC?

Many children in working families live in poverty — some 10.5 million poor

children in 2012 had at least one working parent.[1] And many families with incomes modestly above the

federal poverty line, which is currently about $23,500 for a family of four,

also have a hard time covering the costs of basic necessities. A full-time

job at the minimum wage is insufficient to keep a family with one working

parent out of poverty, and sluggish wage growth for low-earning families means

that many are likely to continue to struggle.

In addition, low- and moderate-income families in almost all states pay

higher state and local taxes as a share of their income than do upper-income

families. This imbalance results from states relying heavily on sales,

excise, and property taxes, all of which fall more heavily on poorer

families. Some states in recent years have become even more reliant on

these taxes, further increasing taxes on working-poor and near-poor

families.

The EITC originated as a federal tax credit for working people and families

with low and moderate incomes that, among other things, rewards work, reduces

poverty, and improves the outlook for low-income children. State

lawmakers can leverage the proven effectiveness of the federal EITC to address

poverty, low wages, and skewed tax systems by implementing a state-level

credit. Just like the federal EITC, state EITCs:

- Help working families make ends meet. Refundable

EITCs provide low-income workers with a needed income boost that can help

them meet basic needs and pay for the very things that allow them to work,

like child care and transportation.

- Keep families working. EITCs help

families that work get by on low wages, which helps them stay employed.

They are also structured to encourage the lowest-earning families to work

more hours. That extra time and experience in the working world can

translate into better opportunities and higher pay over time. Three out

of five who receive the federal credit use it just temporarily — for just one

or two years at a time — while they get on their feet.[2]

- Reduce poverty, especially among

children. The federal EITC is the single

most effective tool the nation has for reducing poverty among working

families and children. It now lifts about 6.5 million people — around

half of them children — out of poverty. State EITCs build on that

record.

- Have a lasting effect. Low-income children in

families that get additional income through programs like the EITC do better

and go farther in school. And children in low-income families that get

an income boost during their early childhood years work more and earn more as

adults. This is good for communities and the economy because it means

more people and families on solid ground and fewer in need of help over

time.

More States Leveraging the Federal Credit, But Others Have Fallen Back

Three states — Colorado (2013), Connecticut (2011), and Ohio (2013) —

recently enacted their own versions of the credit to bolster the wages of

struggling families. Just prior to the downturn, five states had done so

— Michigan in 2006; North Carolina, Louisiana, and New Mexico in 2007; and

Washington in 2008. (Due to the ongoing impact of the recession on state

revenues, Washington State has yet to fund its credit.) In addition, two

states improved their EITCs in 2013. Oregon expanded its credit to 8

percent of the federal credit from 6 percent, and Iowa doubled its credit to 14

percent and will raise it to 15 percent in 2014.

In other states, lawmakers have cut back or eliminated this support for

families earning low wages. In the 2013 legislative session, North

Carolinafs lawmakers allowed the statefs EITC to sunset, ending the credit

after tax year 2013; they also cut its value by 10 percent in its final

year. In 2011, Michigan cut back its creditfs value by 70 percent, and

Wisconsin cut the value of its credit by 21 percent for families with two or

more children. Prior to that, in 2010, New Jersey reduced its credit to

20 percent of the federal credit from 25 percent.

One in three recipients of the federal EITC now lives where a state EITC is

available, and state EITCs boost the earnings of working families by about $3

billion annually.

EITC Design Rewards Working Families

The EITC only goes to working families and is designed to reward their

effort. For families with very low earnings, the dollar amount of the

EITC increases as earnings rise, which encourages families to increase the

hours they work when possible. Working families with children earning up

to about $38,000 to $52,000 (depending on marital status and the number of

children in the family) generally can qualify for a state EITC, but the largest

benefits go to families with incomes between about $10,000 and $23,000.

(Workers without children can also qualify in most states, but only if

their income is below about $14,000 ($20,000 for a married couple), and the

benefit is small.)

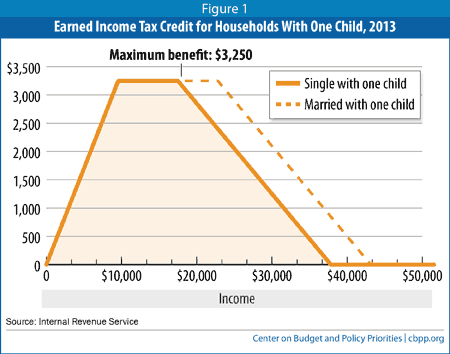

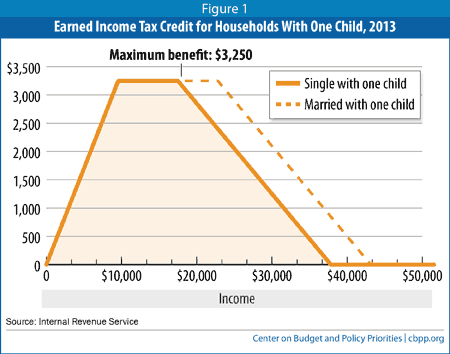

The EITCfs design also reflects the reality that larger families face higher

living expenses than smaller families: the maximum benefit varies for

families with one, two, and three or more children. For example, the

maximum federal benefit for families with two children in tax year 2013 is

$5,372, while the maximum for families with one child is $3,250. (As with

most other provisions of the federal tax code, the IRS adjusts EITC benefit

amounts and eligibility levels each year for inflation.) [3]

Figure 1 shows how the EITC works for a single-mother family with one child earning

the minimum wage in 2013 (about $15,000 a year for full-time, year-round

work). For every dollar she earns, she gets 34 cents in EITC

benefit. The value of the credit continues to increase at that rate until

her earnings reach $9,560. At that point, she receives the maximum

benefit of $3,250. When her earnings exceed $17,530, the credit begins to

get smaller. For every dollar earned above that amount, her credit is

reduced by about 16 cents until it reaches zero (at about $38,000 in

earnings).

Most States Model Their EITCs on Federal Credit

Nearly all state EITCs are modeled directly on the federal EITC. This

means that they use federal EITC eligibility rules and offer a state credit

that is a specified percentage of the federal credit. (The percentages

are shown in Table 1.) Minnesota uses federal eligibility rules, and its

credit parallels major elements of the federal structure; however, it has its

own schedule for the income levels at which the credit phases in and out.

And, Indiana uses old federal guidelines that exclude recent expansions and

improvements to the federal credit.

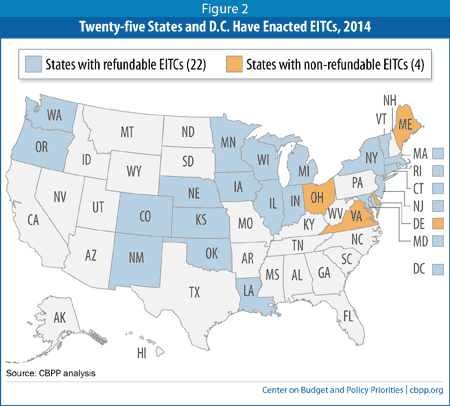

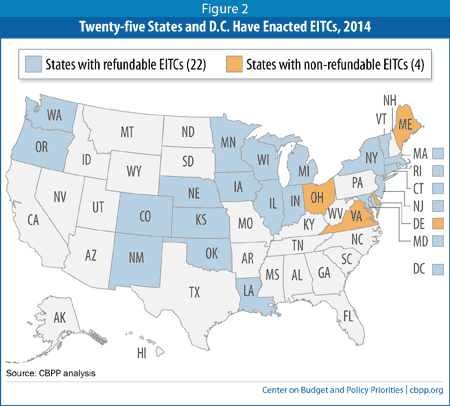

Twenty-one states and Washington, D.C. follow the federal practice of offering a fully

grefundableh EITC. (See Figure 2.) In other words, the amount by

which the credit exceeds annual income taxes is paid as a refund. A

family with no income tax liability receives the entire EITC as a refund.

Without it, the EITC would fail to offset the other substantial state and local

taxes families pay. Refundability is what makes the EITC so effective at

reducing poverty, because it lets families keep more of what they earn and

helps them keep working despite low wages.

In Rhode Island, the earned income credit is partially refundable — a family

is eligible for only a portion of the amount by which the allowable credit

exceeds the familyfs tax liability.

The remaining four states — Delaware, Maine, Ohio, and Virginia — offer

non-refundable credits. That means the credits are available only to the

extent that they offset a familyfs state income tax. A non-refundable

EITC can reduce income taxes for families with state income tax

liability, but it does not make up for other taxes that working families pay,

nor does it do much, if anything, to help keep families working and out of

poverty. The value of Ohiofs EITC is limited even further to no more than

half of income taxes owed on taxable income above $20,000.

Table 1

State Earned Income

Tax Credits |

| State |

Percentage of Federal Credit

(Tax Year

2014 Except as Noted) |

Refundable? |

| Coloradoa |

10% |

Yes |

| Connecticutb |

27.5% |

Yes |

| Delaware |

20% |

No |

| District of Columbia |

40% |

Yes |

| Illinois |

10% |

No |

| Indianac |

9% |

Yes |

| Iowa |

15% |

Yes |

| Kansas |

17% |

Yes |

| Louisiana |

3.5% |

Yes |

| Maine |

5% |

No |

| Marylandd |

25% |

Yes |

| Massachusetts |

15% |

Yes |

| Michigan |

20% |

Yes |

| Minnesotae |

Average 33% |

Yes |

| Nebraska |

10% |

Yes |

| New Jersey |

20% |

Yes |

| New Mexico |

10% |

Yes |

| New York |

30% |

Yes |

| Ohiof |

5% |

No |

| Oklahoma |

5% |

Yes |

| Oregong |

8% |

Yes |

| Rhode Islandh |

25% |

Partially |

| Vermont |

32% |

Yes |

| Virginia |

20% |

No |

| Washingtoni |

Scheduled to be 10% when implemented |

Yes |

| Wisconsin |

4% — one child

14% — two children

43% — three children

No credit for childless

workers |

Yes |

- Coloradofs EITC will take

effect when the statefs revenues surpass the statefs revenue limit

known as TABOR.

- Connecticutfs EITC was cut

back to 25 percent from 30 percent due to revenue shortfalls.

However, the value of the credit is scheduled to increase back

to 30 percent by tax year 2015.

- Indiana decoupled from federal

provisions allowing for a larger credit for families with three or

more children and a higher income phaseout for married couples.

- Maryland also offers a

non-refundable EITC set at 50 percent of the federal credit.

Taxpayers in effect may claim either the refundable credit or the

non-refundable credit, but not both.

- Minnesotafs credit for

families with children, unlike the other credits shown in this table,

is not expressly structured as a percentage of the federal

credit. Depending on income level, the credit for families with

children may range from 25 percent to 45 percent of the federal

credit; taxpayers without children may receive a 25 percent

credit.

- Ohiofs EITC is limited to half

of income taxes owed on income above $20,000.

- Oregon's EITC is set to expire

at the end of tax year 2019.

- Just 15 percent of Rhode

Islandfs EITC is refundable (i.e., 3.75 percent of the federal

EITC).

- Washingtonfs EITC will likely

be worth 10 percent of the federal credit or $50, whichever is

greater.

|

State EITCs Are Easy to Administer and Less Expensive Than Many Other Tax

Cuts

State EITCs are easy to administer and claim. States incur virtually no

costs for determining eligibility for their credit — families eligible for the

federal credit also are eligible for the state credit. And because state

credits typically are set at a fixed percentage of the federal credit, state

revenue departments need only add one line to a statefs income tax form.

State EITCs are easy to claim because filers need only multiply their federal

EITC by a specified rate to determine their state credit.

State EITCs also offer a good value to states. For a modest investment,

they make a big difference in the lives of low-income families. Existing

refundable EITCs in states with income taxes cost less than 1 percent of state

tax revenues each year.[4] Because state EITCs are well-targeted to low- and

moderate-income working families, the cost is more modest than other tax cuts

states often consider.[5] Though low-income households tend to comprise a

substantial share of all taxpayers, they account for a smaller share of tax

revenue. A few hundred dollars for each family makes a big difference to

the familyfs ability to make ends meet without adding up to a major dent in a

statefs treasury.

State EITCs are financed in whole or in part from

money available in a statefs general fund — the same source usually used to pay

for other types of tax cuts. When an EITC is used to offset the effects

of increasing a regressive tax, like the sales tax or gas tax, part of the new

revenue can be set aside to finance an EITC. In effect, the EITC helps

make low-income families whole again after an increase in other state

taxes.

Current federal regulations allow states to finance a portion of the cost of

a refundable credit from a statefs share of the federal Temporary Assistance

for Needy Families (TANF) block grant. Most states, however, have few such

funds, because the value of the TANF block grant — which does not adjust for

inflation each year — has eroded over time. No matter how it is

financed, an EITC can complement a statefs welfare program by assisting

low-income working families with children as they transition from welfare to

work.

Even States Without an Income Tax Could Offer a State EITC

Like the federal EITC, state EITCs have a long, successful history of using

the income tax as a mechanism for providing increased economic security to

low-income working families. But there has been debate about whether a

state that has no income tax could offer similar assistance. Without a

state income tax, state revenue departments do not typically collect the

information about family income and structure needed to determine EITC

eligibility.

The arrangement for Washingtonfs Working Families Tax Exemption, however,

illustrates how states without an income tax could work with the IRS to provide

a state credit.a To confirm eligibility, Washington State will

use data on federal EITC claimants provided by the IRS to state revenue

departments under a data-sharing arrangement. Piggybacking on federal

efforts saves administrative costs for the state. When the credit is fully

phased in, state officials estimate that administration will constitute only

about 4 percent of the cost of the EITC.b If Washington were

to increase the size of the credit, this share would be even smaller.

The other states without a broad-based income tax (Alaska, Florida, Nevada,

New Hampshire, South Dakota, Tennessee, Texas, and Wyoming) could follow

Washingtonfs lead. State EITCs could be particularly helpful in these

states, whose tax systems rely heavily on excise taxes, property taxes, and in

most cases sales taxes. As such, low- and moderate-income families in

these states pay a higher share of their income in taxes than wealthier

families.

- The Washington credit was scheduled

to take effect in tax year 2009, but — in large part because of the recession

and resulting revenue shortfalls — policymakers have not yet financed the

credit.

- Fiscal note for Washington ESSB

6809. Note that administrative costs in states that already have an

income tax are substantially lower, typically well below 1 percent of the

creditfs value.

End notes:

[1] Census Current Population Survey

[2] Chuck Marr, Jimmy Charite, and Chye-Ching Huang, gEarned

Income Tax Credit Promotes Work, Encourages Childrenfs Success at School,

Research Finds,h Center on Budget and Policy Priorities, Revised April 9, 2013,

http://www.cbpp.org/cms/?fa=view&id=3793.

[3] The American Recovery and Reinvestment Act (ARRA), enacted

in February 2009, included two key provisions to help the EITC go

further. First, ARRA expanded the so-called gmarriage penalty reliefh

provision first enacted in the 2001 tax cuts. ARRA increased the EITC

income eligibility level for married workers by $2,000, thereby extending

eligibility for the maximum credit to a greater number of married couple

working families with low-incomes. Second, ARRA provided, for the first

time, a third benefit tier for larger families. Working families with

three or more children receive an EITC equal to 45 cents for each dollar earned

up to $13,430, for a maximum credit of $6,044 in 2013. The value of the

credit begins to phase out for single-parent families with three or more

children when their income exceeds $46,227; and for married couple families of

this size when their income exceeds $51,567. The American Taxpayer

Relief Act of 2012 extended both of these provisions through 2017 and made

permanent the original gmarriage penalty reliefh provision from 2001.

[4] Four factors affect the cost of a state EITC: the number of

families that claim the federal credit, the percentage of the federal credit at

which the state credit is set, whether the credit is refundable or

non-refundable, and how many state residents who receive the federal credit

also claim the state credit.

[5] For further information about estimating the cost of a

state EITC see Erica Williams and Michael Leachman, gHow Much Would a State

Earned Income Tax Credit Cost in Fiscal Year 2015?h Center on Budget and Policy

Priorities, Updated December 19, 2013, http://www.cbpp.org/cms/index.cfm?fa=view&id=2992.